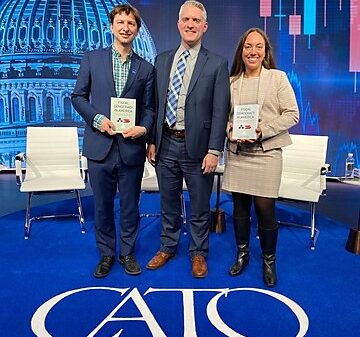

Last week, I hosted a Cato book discussion with Kurt Couchman (Americans for Prosperity), author of Fiscal Democracy in America. We were also joined by Marc Goldwein (Committee for a Responsible Federal Budget). It was one of those rare Washington conversations where political framing falls by the wayside and the real issues emerge clearly: Congress has proven incapable of exerting fiscal discipline, and the debt is spiraling because no real guardrails exist to limit federal borrowing. What we need now are both handcuffs to restrict new borrowing and political cover to address the long-ignored structural drivers of entitlement spending.

The publicly held federal debt, hovering near 100 percent of gross domestic product, has reached heights not seen since the end of World War II. Unlike fighting back against totalitarianism, today’s debt finances political convenience, short-term gratification, and avoidance of responsibility. Congress borrows because borrowing is easy, popular, and largely invisible to voters. When their constituents don’t feel the cost, politicians don’t feel the pressure to change.

But the bill is arriving. Inflation surged in 2021 and 2022 and has stayed above target ever since, interest rates climbed, and federal interest payments now exceed what the United States spends on national defense. In earlier eras, rising debt drove Washington into bipartisan deficit deals. The expected deficit reduction that should have followed the unprecedented pandemic stimulus never came. Today’s Congress behaves as if the basic laws of economics no longer apply to the United States.

They still do.

As the speakers laid out in our conversation, political incentives—not economic considerations—explain Congress’s behavior. Offering new benefits or tax cuts earns applause. Cutting spending earns attacks. And the costs of today’s deficits are pushed onto younger and future taxpayers who don’t carry as much sway with politicians as do older voters who benefit from the status quo.

For a while, politicians convinced themselves that America’s global status insulated the country from fiscal reality. Inflation punctured that illusion, though only briefly. The Republican Congress campaigned on beating back the Biden-era inflation. Once elected, that same Congress hit the snooze button and went right back to business as usual.

Couchman argues that a balanced budget amendment (BBA) is needed—not as a magic fix or an austerity hammer, but as a credible commitment device. Statutory rules can be waived. Multiyear budget limits can be rewritten. But constitutional constraints are different. They give lawmakers political cover to say “no” and create a more permanent guardrail that discourages backsliding.

Goldwein added a crucial clarification: Fiscal sustainability does not require balancing the budget overnight. What it requires is keeping the deficit small enough to not outpace the growth in the economy. Adopting a 3 percent deficit limit or a path to primary balance, which excludes interest expenses, is both realistic and would be fiscally stabilizing. A constitutional BBA should be about establishing long-term fiscal discipline, not mandating year-to-year perfection.

Previous attempts at instituting a BBA were often written to be too rigid or overly technical, trying to script the budget process in constitutional text. Couchman’s preferred principles-based BBA is different. It focuses on broad requirements—balance over time, flexibility for emergencies, and a reasonable transition period—paired with statutory budget targets and a revived budget process that make the rule operational.

The point isn’t to micromanage Congress through the Constitution. The point is to build a durable framework that makes responsible budgeting the default rather than the exception.

And no, the courts are not going to start policing the federal budget. Both Couchman and Goldwein agreed that enforcement would primarily fall to Congress itself, supported by a better, more inclusive statutory budget process.

It can be done.

As Goldwein reminded us, when Congress establishes discretionary budget targets, it never violates them. Legislators may find work-arounds, cut side deals, or exploit loopholes such as emergency designations, but they’ve not simply ignored the targets they set.

One of my biggest takeaways in assessing our fiscal situation is that lawmakers don’t just need constraints, they also need political cover. Many of them know debt is a problem. What they lack is a binding rule that forces prioritization and shields them from the political risks of upending the unsustainable status quo by slowing the automatic growth in entitlement programs.

A BBA can enable both. It limits reckless borrowing and gives members a constitutional justification for saying “no” to new demands and for explaining why a large-scale fiscal correction is unavoidable.

Some worry a BBA would trigger tax hikes. But both panelists argued—and economic logic supports—that the vast majority of adjustment would come from reducing spending, including tax expenditures that act like spending through the tax code. That’s where the waste is, and that’s where real reform opportunities lie. Borrowing lets Congress grow government without forcing taxpayers to feel the cost. With real constraints, legislators would have to confront the inefficiencies voters will no longer tolerate.

One idea that came up during the Q&A is that America’s wealth insulates us from a debt crisis. This is one of Washington’s most persistent myths. Private wealth does not back public debt; creditors cannot claim Americans’ homes, retirement accounts, or business assets when the Treasury falls short. The government pays its bills from tax revenues, which depend on economic growth. That’s why the meaningful metrics are debt relative to the size of the economy and interest costs relative to revenues, not comparisons between federal liabilities and private household wealth.

The bottom line is simple: Most of Congress knows that the debt is a problem. Politicians just refuse to act without being forced. A balanced budget amendment is not a silver bullet, but it may be the only mechanism capable of breaking the cycle of procrastination and denial. The alternative is far worse—namely, when the bond market triggers a full-blown fiscal crisis by demanding interest rates commensurate with the inflationary risks investors are implicitly assuming.

If Congress won’t discipline itself, then the Constitution should help do it—because waiting for markets to impose discipline is not a plan. It’s surrender.